Our Blogs

Explore articles, tips, and strategies to help you make confident money decisions at every stage of life.

Cash Discount vs Surcharging: Which Pricing Model Is Right for Your Business?

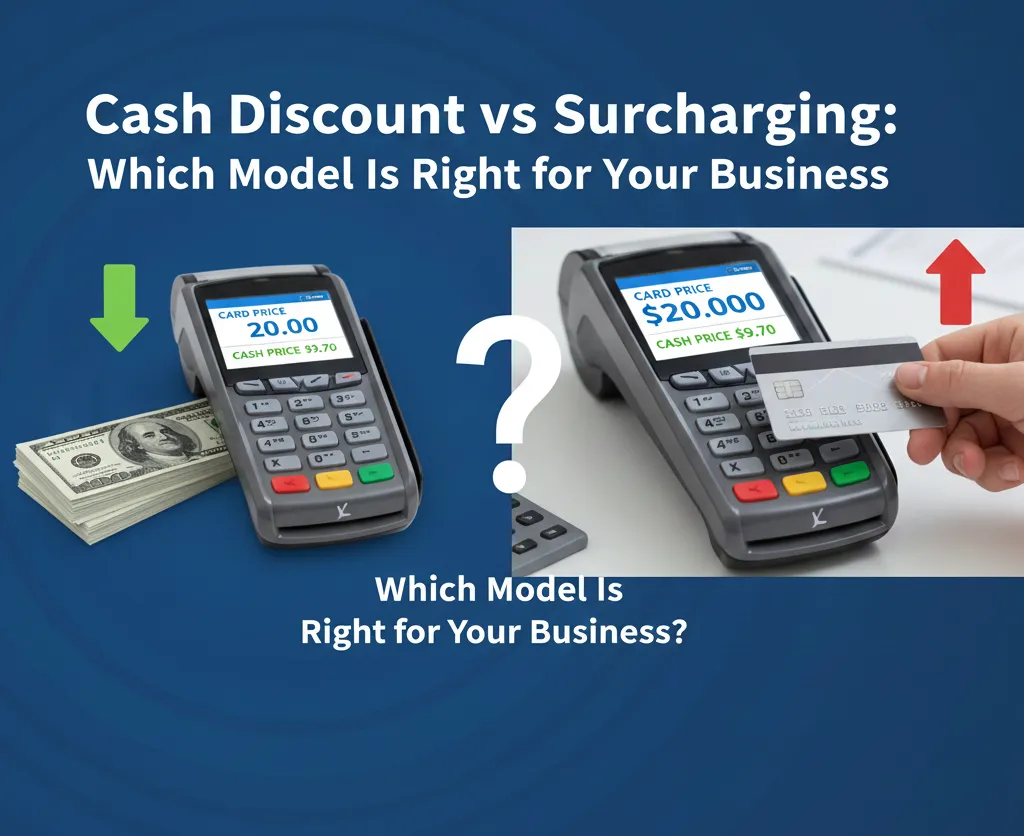

If you accept credit cards, you’re paying for convenience often more than you realize. Processing fees quietly reduce margins on every transaction, which is why many business owners start researching cash discount vs surcharging as ways to offset those costs. While both models aim to reduce processing expenses, they work very differently and carry different legal, compliance, and customer-experience implications.

Selecting the wrong model can result in customer dissatisfaction, compliance violations, or even fines. Choosing the right one can protect your margins while maintaining transparent and compliant pricing. This guide breaks down the differences clearly so you can make a confident decision.

What Is a Cash Discount Program?

A cash discount program rewards customers who pay with cash by offering a lower, clearly posted price. The advertised price is typically the card price, and cash-paying customers receive a discount at checkout.

From a compliance standpoint, cash discounting has long been accepted by card networks and regulators, provided the discount is clearly disclosed before the transaction begins. There is no added fee, just a reduction for cash.

For merchants, this model shifts processing costs away from the business by incentivizing cash payments. It’s commonly used in convenience stores, gas stations, and small retail shops where cash usage is already high.

What Is Surcharging?

Surcharging adds a fee to a credit card transaction to cover processing costs. The base price remains the same, but an additional charge appears when the customer chooses to pay with a card.

This is where complexity enters. Surcharging is heavily regulated by card networks and varies by state. Businesses must follow strict rules, including:

Registering with card brands

Displaying compliant signage

Capping surcharge amounts

Disclosing fees before payment

Even small mistakes in implementation can lead to violations or customer disputes.

Cash Discount vs Surcharging: What’s the Real Difference?

The key difference between cash discount and surcharging is perception and timing.

With cash discounting, customers see the higher price first and receive a benefit for paying cash. With surcharging, customers see a lower price and then experience an added fee at checkout. That psychological difference matters.

Cash discounting tends to feel positive and transparent. Surcharging can feel punitive if not explained clearly, even when it’s legal.

From a compliance perspective, cash discount programs are generally simpler to manage. Surcharging requires ongoing monitoring to ensure signage, fee caps, and disclosures remain compliant.

Is Surcharging Legal in My State?

Surcharging is legal in many states, but not all, and regulations can change. Some states restrict how surcharges are applied or how they are disclosed. Card networks also impose their own rules, which are updated regularly.

This is why merchants should never implement surcharging without professional guidance. What worked for a business down the street may not be compliant for yours.

Cash discounting, on the other hand, is widely permitted when structured correctly and clearly disclosed.

Which Model Saves Businesses More Money?

Both models can reduce processing costs, but savings depend on how they’re implemented and your customer base.

Cash discount programs tend to work best for businesses with a high volume of in-person transactions and customers who are willing to pay cash. Surcharging can be effective in card-heavy environments but carries more regulatory risk.

In many cases, businesses that prioritize long-term stability and simplicity prefer cash discounting or newer hybrid pricing models like dual pricing, which offer transparency without surprise fees.

Customer Experience and Trust Considerations

Payment models aren’t just about savings; they impact trust. Customers remember how pricing makes them feel.

Cash discounting often feels straightforward and fair. Surcharging can feel unexpected if not communicated clearly. Even compliant surcharges can trigger complaints if staff are not trained to explain them properly.

A pricing model that protects margins but damages customer relationships ultimately costs more than it saves.

How to Choose the Right Pricing Model for Your Business?

The right choice depends on your:

Industry

Average transaction size

Payment mix (cash vs card)

State regulations

Customer expectations

There is no universal answer. The best approach starts with understanding your current processing costs and evaluating compliance requirements before making any changes.

Final Thoughts

Understanding cash discount vs surcharging isn’t just about reducing fees; it’s about choosing a pricing strategy that aligns with your business, customers, and compliance obligations. With the right guidance, merchants can protect margins without sacrificing trust or transparency.

If you’re unsure which model fits your business, a professional consultation can help you evaluate your options and implement the right solution with confidence.

Frequently Asked Questions

What’s the difference between a cash discount and surcharging?

Cash discounting lowers the price for cash payments, while surcharging adds a fee to card transactions.

Is surcharging legal everywhere?

No. Laws and card network rules vary by state and change over time.

Which model saves more money?

Both can save money, but cash discounting is often simpler and carries less compliance risk.

Why Circle Processing?

Frequently Asked Questions

Clear answers to help you make confident financial decisions.

Q: What is the main difference between Dual Pricing, Cash Discount, and Surcharging?

The main difference is how the price is presented to the customer. Dual Pricing shows two prices upfront (e.g., $10 cash / $10.40 card). A Cash Discount shows one higher price and automatically applies a discount if the customer pays with cash. Surcharging shows one price and adds a fee at the end only for credit card transactions. Our experts can help you choose the best fit for your business.

Q: Are these fee-elimination programs legal?

Yes. Cash Discount and Dual Pricing programs are legal in all 50 states when implemented correctly with transparent signage, which we provide. Credit card surcharging is also legal in most states, but is prohibited in a few, such as Connecticut and Massachusetts. We are compliance experts and will ensure your business always operates within the rules.

Q: Which Clover device is right for my business?

It depends on your needs. The Clover Station Duo is perfect for high-volume countertops with its dual screens. The Clover Flex is a powerful handheld device ideal for restaurants and mobile payments. The Clover Mini is a compact, all-in-one solution for smaller spaces. We can help you select the perfect hardware during your free consultation.

Q: What makes Circle Processing different from other Clover resellers?

Our focus is on being your profitability partner, not just a hardware vendor. Our core expertise is in the complex, compliant implementation of fee-elimination programs. We combine that with transparent pricing, no long-term contracts, and dedicated, 24/7 U.S.-based support to help your business thrive.

Get Started

Want to work with us?

Let’s create a personalized financial plan that puts your goals within reach — starting today.

COMPANY

LEGAL

SOCIALS

Copyright 2026. Circle Processing. All Rights Reserved.