What Is Dual Pricing? How It Saves Businesses Money

If you accept credit or debit cards, you’ve likely asked yourself how much processing fees are really costing your business. For many merchants, the answer is more than they realize. That’s why interest in dual pricing has surged. But what is dual pricing, how does it work, and is it actually legal?

This guide breaks down what dual pricing is, how businesses use it to reduce processing fees, and why it’s becoming one of the most trusted pricing models heading into 2026.

What Is Dual Pricing in Payment Processing?

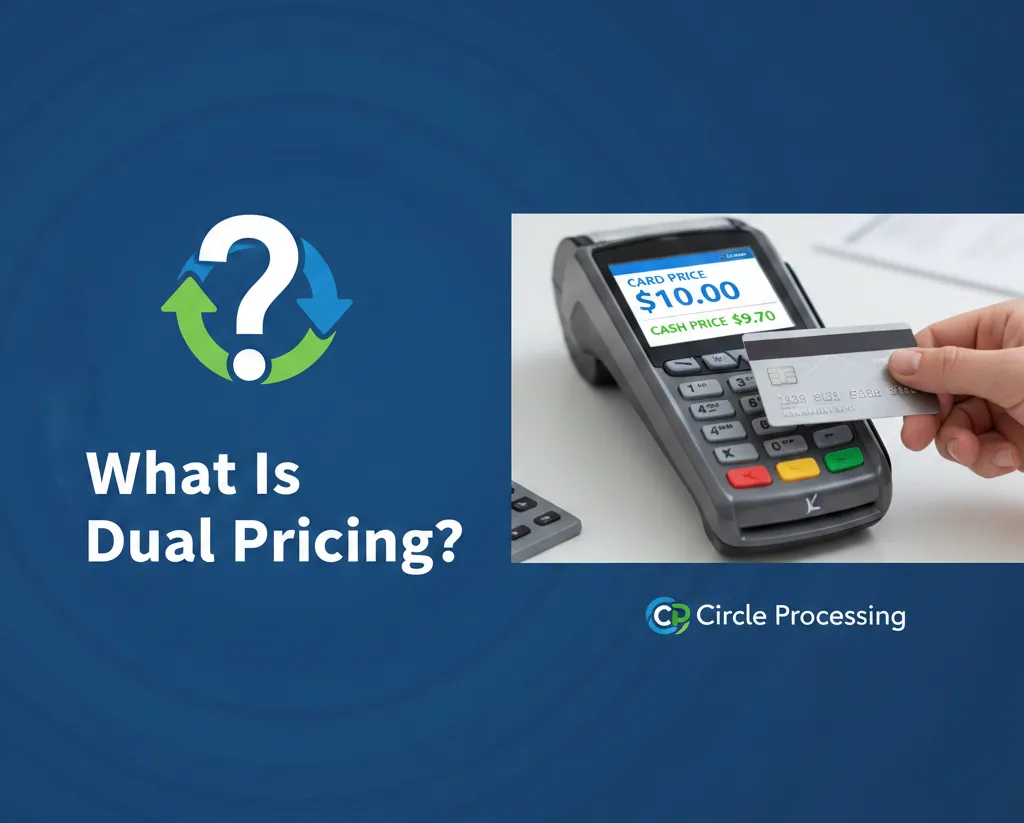

Dual pricing is a transparent pricing model where businesses display two prices for the same product or service:

A cash price

A card price

The cash price reflects the true cost of the item, while the card price includes the cost of credit card processing. Instead of absorbing processing fees or quietly raising prices, dual pricing allows merchants to clearly show the cost difference based on the payment method.

This approach keeps pricing honest and gives customers control over how they pay.

How Does Dual Pricing Work for Businesses?

When dual pricing is set up correctly, the process is seamless.

Prices are clearly displayed on menus, shelves, invoices, or checkout screens. The cash price is shown first, with the card price listed alongside it. When a customer chooses to pay with a card, the system automatically applies the card price, no surprise fees, no math at the register.

Modern POS systems now support dual pricing natively, ensuring receipts, signage, and reporting stay compliant. This removes confusion for staff and customers while protecting the business.

Is Dual Pricing Legal in 2026?

One of the most common questions business owners ask is whether dual pricing is legal.

Yes, dual pricing is legal in most U.S. states when implemented properly. Card networks such as Visa and Mastercard allow cash discount and dual pricing models as long as pricing is:

Clearly disclosed

Not presented as a penalty or fee

Shown before the transaction begins

Compliance is where many businesses get tripped up. Incorrect signage, misleading language, or adding fees after checkout can create legal risk. That’s why businesses benefit from working with payment professionals who understand state regulations and card network rules.

Does Dual Pricing Reduce Processing Fees?

This is where dual pricing truly shines.

By separating cash and card prices, businesses often reduce their effective processing costs to near zero. Instead of paying thousands of dollars annually in interchange and processor fees, those costs are built into the card price transparently.

For high-volume merchants, restaurants, retail stores, service providers, and medical offices, dual pricing can result in significant monthly and annual savings without sacrificing compliance or customer trust.

Dual Pricing vs. Surcharging: What’s the Difference?

Although often confused, dual pricing and surcharging are not the same.

With surcharging, a fee is added after the transaction starts, which can feel unexpected to customers and is heavily regulated. With dual pricing, customers see the full price upfront and choose how they want to pay.

This distinction is why dual pricing is widely viewed as a safer, more consumer-friendly option.

Why Transparency Matters More Than Ever?

As payment regulations tighten and consumers become more fee-aware, transparency is no longer optional. Businesses that explain pricing clearly build trust. Those who hide fees lose them.

A well-implemented dual pricing model:

Improves customer confidence

Reduces disputes and chargebacks

Aligns with modern compliance standards

Protects long-term profitability

This is where experience matters. A compliance-first setup ensures signage, receipts, terminals, and staff training all work together smoothly.

Is Dual Pricing Right for Your Business?

Dual pricing isn’t a one-size-fits-all solution. The right setup depends on your:

Transaction volume

Average ticket size

Industry type

Customer behavior

State regulations

That’s why consultation is critical. A proper review identifies whether dual pricing makes sense for your business and how to roll it out without disrupting customer experience.

Final Thoughts: Dual Pricing in 2026 and Beyond

Understanding what dual pricing is and how to implement it correctly can dramatically change how your business handles payment costs. As we move into 2026, businesses that prioritize compliance, transparency, and education will have a competitive edge.

If you’re considering dual pricing, the smartest next step is a professional consultation. The right strategy can protect your margins, keep you compliant, and build lasting customer trust.

Frequently Asked Questions About Dual Pricing

How does dual pricing work for customers?

Customers see both prices before paying and choose their preferred payment method.

Is dual pricing legal everywhere?

It is legal in most states when properly disclosed, but local regulations vary.

Does dual pricing really eliminate processing fees?

In many cases, yes. Businesses often reduce their net processing costs close to zero.

Will customers react negatively?

When explained clearly, most customers understand and accept dual pricing.